This is the 10th annual Year-in-Review for my project: The Standard Dota Hero Guides.

If you want to skip to my personal message, scroll down to “My Life & 10 Years of Dota Guides”

This year is the 10th anniversary since I started the Dota 2 Hero Builds Project! For 10 years, I have been writing Year-in-Reviews for this project and with each iteration, I treat it more as a personal outlet than a public display about the guides.

The more you get your name out there, the luckier you are to meet people you like. I’m thankful for the community of friends I’ve learned and grown with over the years.

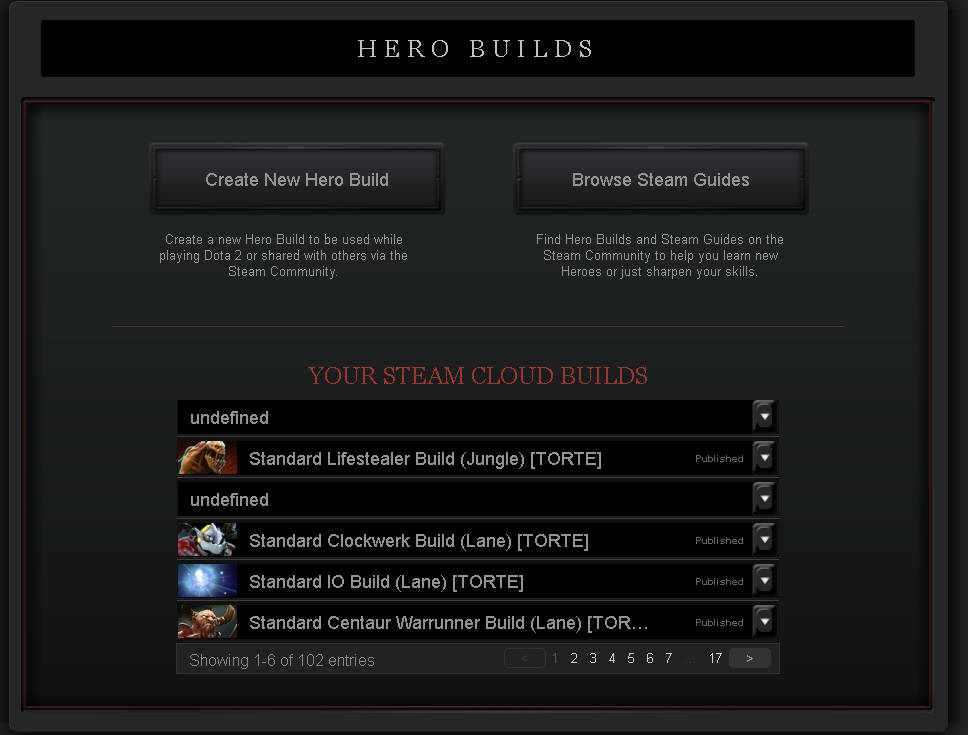

If you don’t know what Hero Builds are, they’re guides integrated into the game which help provide the optimal way to play a character/hero based on high tier data and pro-level and community feedback. Suggestions for which spells to level, items to purchase and descriptions for their application can all be found within these Hero Builds. For a competitive game like Dota 2, having this resource helps players of any skill level play to the current “meta” with confidence and strong team cohesion.

Statistics

Records

After 10 years, the guides’ growth is unmatched by anyone else. To summarize:

- 3.76 billion matches have been played using my guides, averaging 1 million daily

- Over 555 million total subscriptions – 55 million new subscriptions annually

- #1 subscribed guide on Steam: Phantom Assassin reaches 6.6 Million unique subscribers

- Pudge is the most played guide across all of Dota 2: 86 Million matches played

- 72,000 changes applied across all guides, 250,000 tooltips revised and rewritten annually

- Reviewing & revising guides every day for three hours – additional 5 hours if testing guides

- Every single change catalogued and announced via YouTube, Twitter or community posts for 10 years

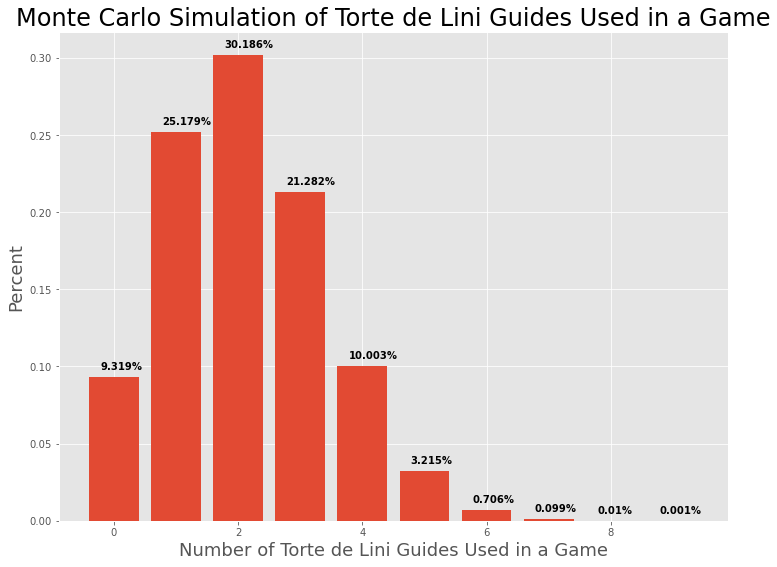

Global Influence – 90.68% of all daily matches

Approximately 90.68% of all daily Dota matches use one or more of my guides according to our data. The percentages represented show the likelihood of 0 to 9 guides simultaneously being used during any match. In 2021, it was 86.27% so there’s a growth assumed to be associated with the increased returning player-base when the battle pass and Arcana cosmetics were given away in December 2022. In terms of alternative guides, the second most popular guide creators are around 720 million total games played. In all literal forms of the word, I can safely say I am a Dota 2 influencer and that’s kinda neat to think about taking that word back. That said, there is a certain pride in ensuring that I continue to earn the responsibility of determining how players will enter each game, millions of times a day, every day.

10 Years of Dota Achievements

The more you get your name out there, the luckier you are to meet people you like. I’m thankful for the community of friends I’ve learned and grown with over the years.

For the guides, while the quantitative is impressive. I am always taken aback by who is supporting, endorsing or using the guides, especially from people and organization I’m fans of. From pro-players to OpenAI, I tried to capture and collect every moment where my heart skipped a beat with elation. No matter the reason my guides were selected, I try my best to make that choice the right one for those who trust me.

The distance we go to be somebody among our family, friends, school/workplace or even the world, always starts with mattering to ourselves. That internal motivation lasts for as long as when we see a path to reach tap our pride among that fog of insecurity and self-doubt. Looking back, the attention I received for my guides is incredible but I also know that the day-to-day pursuit to make the best guides comes from my passion, enjoyment and that motivated pride. I’m lucky I have the time and availability to do something I love and enjoy and get to be part of a game that’s been close to me for nearly 20 years.

___________________________________________________

Processes & Policies Updates

2022 Policy Updates & Additions

These policies re-iterate upon the areas mentioned in 2021, specifically improving the extension & luxury items tab categorization so it is more seamless for players:

- Extension Items has been refined based on the 2021 applications where recommended extension items are now upgrades or replaceable items from your core items. It can also be items that you would buy almost always after your core Items.

_ - Luxury item recommendations have also had their definition refined to being late-game situational defensive or consumable items like Moon Shard or Aghanim’s Scepter recipe. Luxury should be viewed as your final sixth item, a niche counter to specific heroes (like MKB for evasion-based heroes) or upgrades to extension items that take a secondary priority versus the essential purchases.

_ - Some ability tooltips now reflect if it should be used to secure ranged creeps when laning.

Continued 2020 & 2015 Processes & Policies

These policies have been in place since 2013 or later, but were only written for posterity in 2015 and added upon in 2020:_

- Guides are based on data, pros’ feedback, user discussions and observed matches.

_ - Hero builds are constructed under the assumption that the player is performing well. There’s a Situational Items tab to alleviate challenges if the player is underperforming or playing versus specific counters.

_ - Six items maximum per slot to reduce burdening players with too much choice and to emphasize the most popularly-used items.

_ - Dual Core Builds are for heroes like Wraith King & Monkey King, who have multiple playstyles.

- Guides try to be updated within the first 48 hours after a large patch release.

- Instructions on each guide category tab states how to use the guides for players.

- Annual tooltip text rewrites are made to keep the guides helpful and updated for players.

My Life & 10 Years of Dota Guides

Looking back on my life, I would summarize it as being slightly off-center. It’s not exactly how I would’ve wanted to live but it’s in the ballpark of what I could hope for. A simple example would be that I’m happy I got to grow up playing video games… but my first console was the CD-i. Or for example, I love how ethnically diverse I am as the son of a Swiss-Jewish-Egyptian refugee and a Ecuadorian-Spanish New Yorker… but I’m regularly confused (or discriminated) for other nationalities. Lastly, I feel fortunate to have two parents… but they were the victims of their own stories and the villains in mine.

So when people ask me why I make guides, my initial response is simple: I was frustrated by how my teammates were building their items and I channeled that sentiment into doing something productive about it. But the off-center answer is that my motivation comes from an attempt to reject a childhood history of institutional failure and feelings of ineptitude. Simply put, I was trying to dismiss my becoming of the bare minimum of a living person – something that everyone was predicting at that time. The ten years that followed had a lot of ups and downs for me but thankfully the guides stayed a fixed point of definition as to who I am and wanted to be._

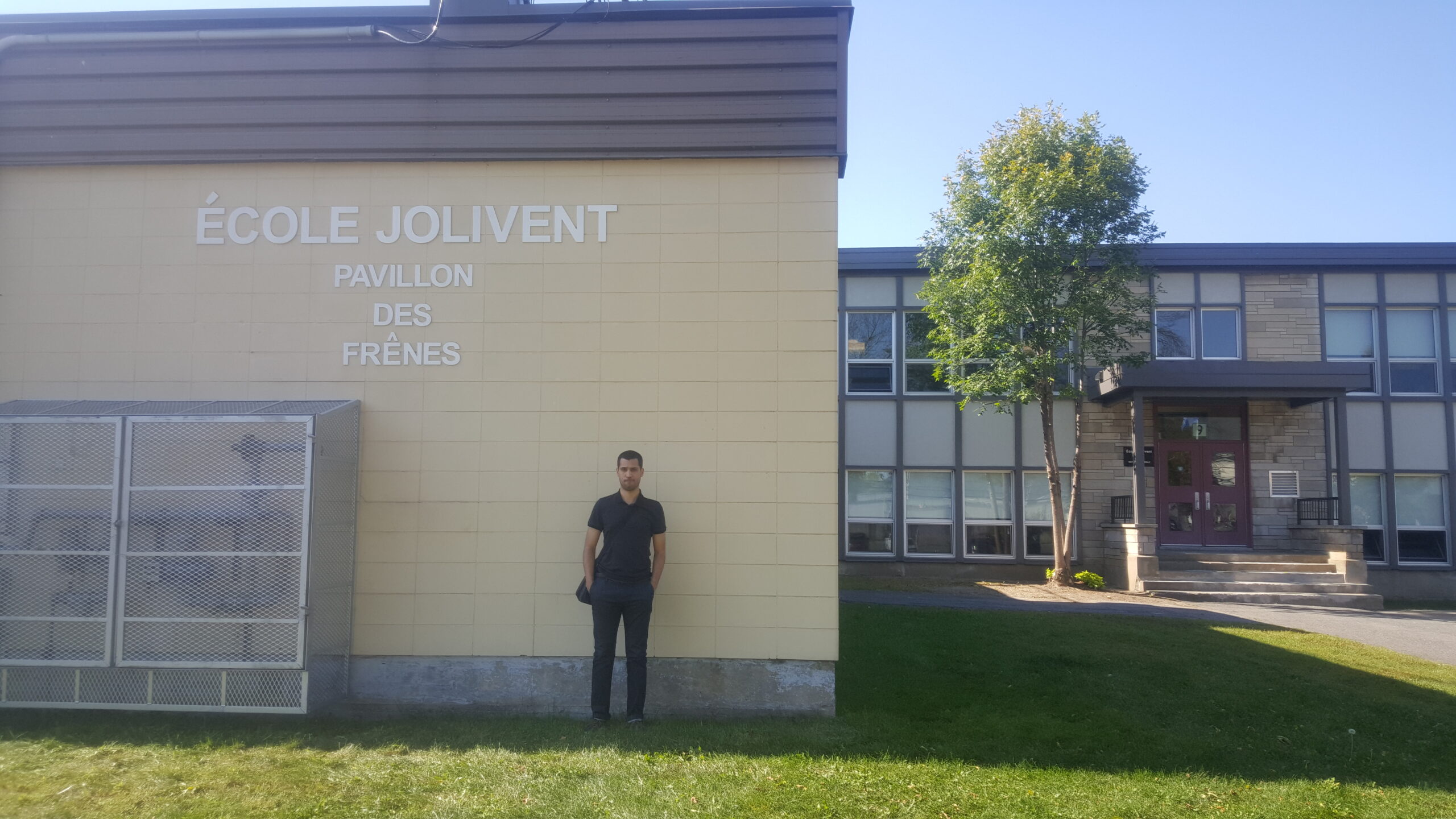

Before Guides

Growing up, I was labeled two identities that I would try to reverse for the next 13 years. I was a:

- a socially misfit kid trying to fit in a society where he wasn’t the same ethnicity, didn’t speak the same language or celebrate the same culture. He was two years older than his classmates, having repeated his sixth & ninth grade, and an annoyance to teachers across multiple high-schools. For the next nine years, he would consecutively attend summer school to achieve a passing grade.

and I was also a:

- A reclusive and lonely son, waiting until school started again to get away from a physically and verbally abusive single parent. During the summertime, I would visit my depressed, yet disconnected father, where we experienced, for a time, homelessness.

DotA — and other games like it — carry the infamy of being toxic and hostile environments, but compared to what I was going through, the trivial bickering in the game meant that we were at least trying to cooperate, something I yearned for in my actual life. What’s more, people actually spoke English, a rarity to where I lived at the time. Video games were a distraction for me: a shower of dissociation washing away the pain of my adolscence, and at the same time a tool to stay connected with at least one parent, who at the time was struggling to stay afloat financially or even relate to his children. The combined adversities I faced growing up lead me to three institutions of thoughts that I retain to this day: I hate weekends, I need to work twice as hard to be average and nobody likes me by default; I need to be something of value.

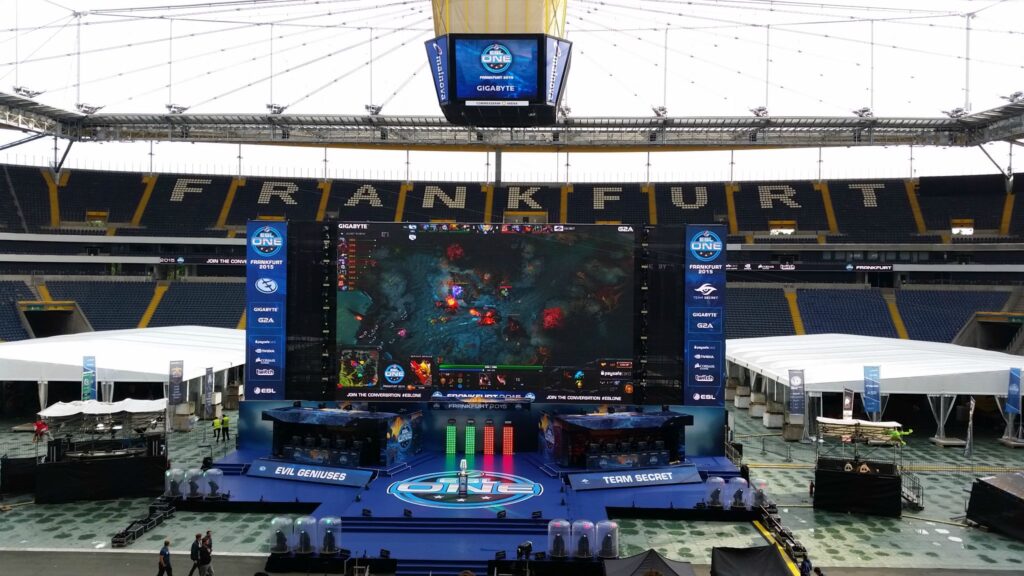

One of my events was BarCraft Montreal at the now-defunct Club 1234. In coordination with the venue manager, we secured sponsorship, equipment, cooperation with Evil Geniuses & MLG and got to be featured on the official tournament broadcast.

Taking what I learned, I entered CEGEP (college) with a desire to do more. Part of the reason was because I was sleeping on a couch without my own room for the first year, which meant finding any justification to get out of the apartment. My first attempt: volunteering at a retirement home – to prove I could do something, anything. In that regard, the volunteering was a success and I would go on to take things a step further in university. I volunteered to:

- start my own esports university club and jump-started two more in neighboring institutions.

- help with tournament organizations at our local LAN events: LAN ETS and contributed to WCS Canada for Blizzard Entertainment.

- organize major viewing parties with hundreds in attendance.

- manage over five esports teams and 50+ players.

- write articles for four established esports publications.

- created my first “guide”: Team Liquid forums Rules & FAQ

- finish my university degree in three years instead of four.

Throughout these experiences, I was making up for lost time as I knew that once I graduated, I would have to find a job. Having a degree in Sociology was a relic of my past than a potential future in terms of employment. Especially true when the degree chosen was on the basis of my family’s instruction to “pick something you can get a passing grade in”. All I had on my resume was a tenth grade level of Mathematics and working in QA for some popular AAA games like Mercenaries II, Command & Conquer 3: Tiberium Wars, The Simpsons and Batman: Arkham Asylum.

Working double-time on projects, summer school and trying to graduate as fast as possible lead to 14-hour workdays and weekends but also came with sacrifices like missing out my only high-school friend’s funeral. I was so caught up in trying to get clarity on my future that I did not get to say good-bye to my past and the few gems that remained.

My Work During Guides

When the guides system came out in February 2013, I was graduating and ready to start my own life. The cost to do that would be everything I previously owned but in turn, I would go on to be a part of many different start-ups including a TV studio, a digital magazine, a live-streaming platform, an investment holding, a CS:GO Major, Dota Minors and Majors, three esports teams, three company acquisitions and more. For each new chapter in my life, it meant I had to start all over: move to a new country, buy all new furniture, make new friends and build a new company. But it also meant another try at reinventing myself and exploring what I can do.

2013: Berlin

My first job was at a company called ESGN: a 20-million dollar attempt to be an esports federation (in partnership with ESL, Gamefy and GOMTV) and a TV studio for everything esports. Coincidentally, I had gotten the role of business development and operations manager because I emailed the company blindly and one of my future colleagues read the very website you are reading now. Lead by non-English speaking Koreans, I was asked to move from Montreal to Berlin with my Swiss passport. A passport my family withheld with disapproval of my going. The company was rife with community rumours and they deemed it would not be prudent for me to leave. For a decade, I had been lead to believe that I was incapable of handling my own money, personal documents, family heirlooms or even permitted to purchase my own things. Thus, to get “permission” to leave for this job, I had to sign over my bank account to my family under the guise that they’ll manage it for me. With no choice, I signed and left for Berlin with whatever I could fit in my two suitcases, couple hundred Canadian dollars and a pocketwatch. A few months after I left, my bank account was emptied and I chalked it up as a cost for my freedom.

As with most start-ups, the company didn’t last and many community members were vocal about how much of a fool I was. That said, knowing what I was running away from, I was thankful for this company and continued working for them during their last months for free. My CV at least gets to read that I worked with Capcom, Riot Games, Valve (with Mike Dunkle, died in 2018), Blizzard and launching a TV studio. Contrasting Berlin and German culture with a Korean-lead workplace was an interesting mix of European standards of living versus Korean (sometimes unhealthily) work ethic. I also saw how being a foreigner gave you a lot of leniency for mistakes you made and I would see this repeated again when working in Russia. Though the studio and our launch were extravagant, it was misaligned with the, at its time, scrappy nature of the esports industry and was frankly not pragmatic. That said, my first foray in the real world, in another country, was a great lesson in my life. More importantly, it confronted me with a reality that I was on my own to find my next opportunity and to manage my finances in view of that. For the next 10 years, that financial insecurity persisted, with my personal effects staying relatively the same throughout. It was necessary to make relocation easier for each and every new role.

2014: Copenhagen

My next start-up was a digital magazine at Aller Media, one of the largest publishing houses in the Nordic region since 1875 (yes, the 19th century). I was fortunate that this personal website had once again garnered interest from another employer. They had asked me to be the managing editor for an esports magazine. With only a small sum of money left and nowhere to go, I accepted the role, excited to be going from TV to magazines though I think for some – that’s a step back in terms of media consumer direction. The greatest challenge of this role was trying to steer an old publishing house into going digital, let alone towards an international audience whilst they were earning millions with an aging population. With this venture ending as quickly as it went, I was still living in my suitcase and obligated to leave another great country and the few friends I just made in Copenhagen. My professional CV got a bit fatter: publishing a digital magazine and managing over 30 members. It definitely made me doubt if I was on the right path or one that was just going to be filled with failures. My Dota guides kept me sane for the months I was, again, unemployed. For the first and only time, I tried playing ranked and reached 5,000 MMR though I didn’t feel any more accomplished and decided that I just didn’t enjoy ranked whatsoever as the incentives to be a high rank were small in comparison to my ambition to do more in my career.

Being in a startup within a corporation was the worst of both worlds: you had very little funding, no job security and you had to justify your spending at every turn to a corporate machine that only made decisions through numbers with minimal risk. Learning the Danish culture, life and how hard taxes hit (55%) was all part of the experience living there. Though I personally felt the city was too small for my tastes, I do love how convenient and straight-forward everything is in Denmark: automated taxes, card-swiping my information at doctor appointments, relatively good public transportation and the dark, cold nights similar to those in Quebec during winter. The Danish people also taught me how to dress much better and what a balanced work-life looked like. In another life, I could definitely see myself living in Copenhagen and not just because their sarcastic humour and funny-sounding language are so appealing to me. An interesting social dynamic trait I was noticing was that if you’re a foreigner in a country where they don’t speak English, they will try to speak English in front of you. However, if you stop engaging or talking, they will eventually shift back to their native language. Even for a country as comfortable with English as Denmark, this would occur.

This meant that any social gathering I was in, I was reminded that everyone was speaking English for my sake, and thus out of respect, I would have to burn myself out ensuring that my involvement continued to justify their courteous language switch. This butted heads a lot with my self-perception that the more I routinely exposed myself to people, the more annoying and eventually disliked I would become. Putting more effort into avoiding that sometimes incurs that negative consequence even more. For sure, my social skills were undeveloped when I first started experiencing the world and they have yet to catch up in comparison to those I admire or wish I was more personally like (at least in the personality department).

2015: Los Angeles

Still with my two suitcases, I took another role all the way in Los Angeles. My thinking was that as esports and gaming investment interests were ramping up, being around one of the central locations of those sectors would make finding future roles easier. I took a job as business development director at a live-streaming company called Azubu (with immediate skepticism that it would last). With two start-ups on my belt, I could immediately identify problems with this one. For starters, compared to Copenhagen who helped get me situated in a country that I was not familiar with, Azubu accommodated only the necessary. It had been 14 years since I’ve lived in the United States and I did not feel very welcomed upon arrival. My luggage — the total sum of my private possessions — were in an office that was closed for the weekend and I was jetlagged from my flight and needed new clothes to wear. To help the company save on costs for my relocation, I had sent my belongings weeks earlier. This now put myself in a situation where I was locked out of my things and could not go to my temporary living quarters until I could retrieve my things. I sat in that empty office building lobby for the next nine hours, hoping to cross someone who would be working on the weekend just so I could have a spare set of clothes. From the business side, the company would spend excessive amounts on content contracts but simply could not make any deals that would recuperate those commitments, let alone find new funding with a product still trailing behind competitors. It did not help that the CEO didn’t even live in the same country as the company, let alone do anything more than make press appearances. Seeing such a distinctive difference between the true drivers of a company and leadership who remained out-of-touch was an eye-opening experience for me when it came to future opportunities in my life.

My time at Azubu taught me that I would not fit in the United States nor the work culture that often dangled opportunity as a motivation to get you to do more. More stupidly, I naively thought I could live in Los Angeles without a car or a driver’s license and wish I did more research about the city as I had never been to the West coast let alone knew where Los Angeles was on a map. One thing I do miss about America is how indulgent they were and unapologetic for creating food monstrosities that were more focused on reaching triple-word Scrabble scores in their name than finding a balance in their ingredients. I also miss how in the USA, stores are open past 6PM unlike here in Europe. That said, it also means that someone is sacrificing their nights just to serve the few night owls for the rare times we leave our apartment.

As for the guides, I was starting to notice an uptick in recognition and reception to my work. As the builds cloud system continued to fail and delete guides for others, I remain resilient and dedicated to a project that once again served well in making me feel productive as I went on to look for another job. Though most people I met for work were into League of Legends, I didn’t relent in my dedication to Dota and how thankful I was that I could be a part of it even when my work had me focused elsewhere.

2016: Moscow

I considered Azubu to be the lowest point of my career and now ESforce would be one that accelerated my experience exponentially. After Azubu, I leaned heavily into how different I was to everyone I had ever met. My good friend and colleague, Oleg Kogut (died in 2020), reached out about an investment fund needing help in understanding the international audience and that I might be a good fit. By this point, I had learned two key lessons when it comes to taking on new roles: 1. the riskier the project, the more money I should ask and 2. always say “yes” and “I can do that!” and then figure out how to do it. After a phonecall with leadership, I flew 16 hours to Russia and met their CEO (died in 2023). In the hallway were two bodyguards whose fists were the size of my head and the country did not resemble anything like in the movies. The city-center was this incredibly modern and light-filled metropolis whereas on the outer rim was this cold and barren architecture where yellow streetlamps barely pierced through the darkness. I continue to say that the city still has the best burgers I’ve ever eaten thus far (FARSH).

My role, initially, was to launch their international media company called Cybersport. The investment holding treated me well and I moved up to be Head of International Strategy & Operations which involved having a hand in international communication, business strategy linked with six subsidiary companies like VP & Na’Vi as well as direct involvement on Dota Majors: Epicenter. My only complaint was, once again, I had to relocate from Los Angeles to an undetermined location in Europe. So I sold all my belongings, slept on the floor until my rental period ran out, moved into hotels and AirBnBs for nine months straight until ESForce settled on a location for our offices. I paused my life, getting settled or living in my own apartment for a company’s slow decision-making. I told myself I’ll never go to those lengths for another business again as the sacrifice took a toll on my health, happiness, ability to work and quality of life. All that said, working with Russians was much more straight-forward than America where the hierarchal lines of an organization meant that you were the person who made the decision and people below you would execute with few opinions being exchanged. I also found them extremely hard-working, to the point of exhaustion and felt their work ethic was increasingly unhealthy as an environment. In terms of culture, yes there was some drinking but not as much as I stereotypically assumed. I did find out that there are different intonations you could say bylat which is a nice feather in my cap.

With each period of unemployment came a thankfulness and appreciation that I had the Dota guides. They were an exercise to stay pro-active and proof that regardless how the job market rejected or accepted my candidacy, I had a modicum of personal success stemming directly from my hard work and dedication. It didn’t pay the bills but certainly kept me sane for years when I felt isolated from the world. My experience at ESforce was an embracing of everything I had learned from the past and it gave me confidence that I had moved on from being a newbie to esports to a veteran who had plenty of a variety of experiences to call upon in future projects and consulting.

2017-2018: Berlin

In 2017, I was contacted by Valve Software regarding the hero builds cloud-based web system’s current situation. It was in bad shape that had driven most creators away from wanting to make guides. Though I was in contact with one of its developers, I believe he had retired some time last year (2016) and the system had fallen into a state of disrepair. For most of 2017, I was reached out by several staff at Valve about fixing the current version of the system and then providing expertise on what the new, in-game, system would look like, what features build creators would need and how we could make it monetarily more sustainable for creators to continue making guides.

Over 300 emails were exchanged between us as we worked on a more integral, easy-to-use and fair system that made it both convenient for players to create and get visibility on their guides. Not only did this experience take advantage of my work in AAA game production but also gave me a taste of system/feature design where a flow of ideas, opinions and suggestions would come to be implemented directly in the game. It was a step beyond designing builds for players and it was exhilarating to see the fruits of our labour being directly used by the player-base. Since then, over 250,000+ new guides have been created. In parallel, this year is where the vocal community started noticing my Dota guides after I had accumulated over 200 million subscribers, 700 million games played. That popularity lead to my invite as talent for The International 2017 and I got to meet a lot of the faces I worked or spoken to at Valve. On the flipside, with a more robust in-game system, it gave new guide creators more visibility, which in turn, shifted a lot of frustrated followers of my stuff to use alternative creators that more accommodated their needs. It’s thrilling to see more choices and diversity in guide formats and approaches than ever before. I’m thankful that some people at Valve trusted my first-hand experience with what Dota, new players and creators needed and to be a direct part of the game in a way I could ever dream of.

As for my full-time role at the Moscow-based investment holding, ESForce would go on to sell for over 100 million to the Mail.ru Group and focus exclusively on the CIS region.

2018-2019: Kyiv

Towards the end of 2018, I took a break from doing Dota guides. As I wrote back in 2019, I had achieved everything I wanted with the guides and the motivation was no longer there in continuing for the time being. I set the guides to private and wiped them clean so players would not continue to use them and ultimately move on to other guides as I always hated when people stuck with outdated guides. However, I was not aware that re-publishing the guides to a private setting would set them back to public viewing and leave players confused as to why there were blank guides (this error has been patched by Valve). An attempt to end things the right way had backfired and I continue to feel those consequences today. I’ve unfortunately had to pull back from interacting with certain communities due to death threats and recommendations to commit suicide. I feel that if you try to directly correct a wrong in people’s eyes, whether fairly or unfairly determined, it will only hardened their stance. The goal should be to remain consistent in your doings and to continue what you love to do. Nonetheless, throughout the next few years, those old childhood feelings resurged and made me feel helpless for so long, unsure of what the right approach was that didn’t indulge the hate and anger I was regularly on the receiving end of. I spent the next few years focused on myself and what made me feel the most proud of and just discarding the rest. The only flaw in that approach is that it stifled my desire to try and do anything else and made me feel paralyzed in taking any risks in fear of retaliation and harsh judgement. By exposing myself more, I gave more ammunition to those who thrived on anyone or anything being different. If you took their criticisms seriously and try to improve yourself, they would find a new reason to dislike or dismiss you. There was no winning but worse, it made you feel leashed to a hatred that sometimes had no basis.

I trudged onward with my professional work and my next role was working with StarLadder in Ukraine to do marketing for their Dota Minors, PUBG Europe League and the CS:GO Berlin Major. The company itself was nearing its end as senior talent exited for greener pastures and even the person who had hired me, left within a few months of my start. I was brought on to smooth things over with the PUBG Corporation as there was a very clear difference in communication, work culture and functionality between a veteran start-up and a game developement corporation. While I did fine in reassuring them that things could change now with someone who they could more align with culturally, I ultimately ended up being a symptom of a larger issue that plagued the organization before it would eventually wither into oblivion. After this role, I received a diagnosis that required me to re-assess my past, determine how I would function for the future and to live with a shame of these new challenges when rationally, there was nothing to be shameful of. I finally settled in the country of The Netherlands where I still live today and moved on from StarLadder as it continued to crumble.

2020 to Present: Amsterdam

During COVID, I would continue to spend most of my life dealing with health and mental challenges that I had long ignored, some large and some small such as fixing my speech impediment, learning I have flat feet (turns out I was not as lazy as I thought, just bad feet) and getting into shape. With no job on the horizon, I had a lot of time to learn about what I wanted in life such as balance and stability, things I had given up for a tumultuous career. On top of that, the Dota guides gave me a sense of purpose when the market made me feel inadequate, undesired and unqualified. When I see how many new games were played with my guides, it gives me a feeling of personal success versus the lack of professional achievement I was reminded of every day. More importantly, being here in The Netherlands for longer than a year was its own success. It meant that I have built myself up, gradually, to a point where I could be stable between work and, thus, be more selective of roles outside of salary or stability.

I started live-streaming to pass the time, talk with those who wanted to hang out and use it as an outlet for people to give me feedback. Previously, I tested guides privately but found a lot more enjoyment ensuring the builds’ quality publicly, though a lot of people chose those live-streams as a way to determine my skill-level and thus interpret it as a level of my guides’ quality when the two were seldom related. I also started exploring healthy projects that were outside career growth: enrolling in an Executive MBA, taking up piano, learning video-editing and trying to work out at a gym. Having a lifestyle where I worked for others but also focused on myself meant a better self-esteem, without a constant feeling of comparison. I was doing something, even if it lead to nothing, didn’t pan out, or could not hold my interest. My view was: if I just stayed busy then I wouldn’t have the time to dwell on what was wrong or missing in my life. The guides taught me to appreciate my slice of value but more importantly to focus on myself rather always in reflection of others.

For the years after, I went on to help complete the sale of two additional companies. I continued to work on Dota 2 guides and sought to learn other industries (tried web3 – not recommended). I am now finishing my work in the mainstream gaming sector revolving around partnerships with game developers and operational strategy for a large search engine technology company. The past ten years have been a transformative period of being nothing to doing as much as I can to change that. Just as my life started before the guides, my life over the years were not perfect, but had an off-centered goodness that I appreciate more and more in retrospect. A lot of bad moments were glossed over, the times I’d get scammed, mistreated or taken advantage of. But also a lot of incredible moments in my travels, both for work and for leisure, go uncredited. Every company I invested my time and life into, helped me get my legs in settling in, making friends and understanding how their country and lives worked. I learned how to ask for help, to try and always give help and, most importantly, to invest my time with the people who I truly believed in. I’ve matured, quite simply. I’ve grown not just in terms of verticality but in a horizonal dimension that gave me depth in how people live, learn and function.

My Future and Guides

I consider myself fortunate. Lucky that my past didn’t dictate my future (as much). Blessed I have the ability to explore ideas and grateful that for all my mis-steps, the consequences are some shut doors of opportunity and not the complete end of all things. Ultimately, I am thankful I can still be a part of a game I have cherished for nearly 20 years and that my involvement is appreciated by millions of players.

My past life was juggled by two identities: professional and personal. I am known here for my guides whereas in business, I am a veteran of ambitious start-ups (with its successes and failures). I have had an upbringing of insecurity that has created this maturity to aspire. While in the past, I have transformed myself to what was asked of me, I no longer change myself to become what others expect of me. Instead, I now have the self-esteem to be comfortable adjusting who I am to what works best for every situation. I am a foreigner in every sense of the word and I can live with that. Actually, I thrive to be that now.

I do not know how long I will continue to make guides and I will likely need to reinvent myself once more for my future. In an ideal world, it would be lovely to have Valve support me to continue making guides (and maybe help with other parts of Dota). But that is more of a hope than an expectation and for now, I’ll focus on living by the day’s step rather than where my stairway could lead to.

“My father used to quote Zig Ziglar, saying: your attitude, not your aptitude, will determine your altitude. And while I’m sure there’s a bit of blissful optimism sprinkled in that cheesy line, it has helped this relatively average person accomplish something above-average. If my father’s message is, in reality, untrue, then I am at least appreciative of how far my overcompensating efforts has reached.” – June, 2022

Conclusion

For years, I hid my history in concern that I would be perceived more differently than I already am. I only wanted to talk if it would be useful (or at least it made me feel useful). More importantly, I wanted to write about it when I could finally walk out of that tunnel of past challenges with my head held high from my own merit. That is my function, that is how my positive emotions are constructed. Though, I can name many experiences I would never do again, emotions I never want to feel nor types of people I wouldn’t want to cross paths with – I would do it all again if it means being where I am now and with this comfort of belonging.

Dota is challenging in so many ways for all of us. It’s given us a yearning to learn when school has wringed our curiosity dry. It’s taught us to deal with some of the most incomprehensible people. It’s helped us mature and take control of our emotions for the greater good of the team and our collective desire to win. Better yet, the game confronted us on the idea of letting go of frustrating moments and outcomes that are beyond our control. Every day, I can feel those parallels I’ve learned from Dota applied to my adventures around the world. I’m thankful I could extract so much guidance from the game to help overcome my life.

Looking back on my life, I’ve found there were so many pitfalls that would forever label me a victim. Traps where I would end up emotionally clinging to a pathetic dimension of myself as the only way I know how to live and frame my life. I stand tall, in defiance of what was predicted from the faces that once knew me most: educators, family, past employers. There is nothing remarkable about me except a discipline to persevere and a stubbornness on giving up, to give into every naysaying comment that seeks to dismiss my presence as more than a nuissance.

I will always try to fit in, to the best of my ability, and I will always look for new places where I will try to matter and do things right. I am part of the Dota and gaming community, for better or for worse. It only took me many difficult years, that asked a lot from me and my happiness, but I’ve achieved my hill to lie down on and stare into the clouds for more hopefulness. I’ve been fortunate enough in my life that the foundations of my failures, from childhood to career, has granted me an ability to savour the times where I have finally accomplished something, regardless how personally small or publicly grand. The guides came at the perfect time, a cross-section of my failure in the past and the ambition to do something to change that for the future.

Guiding Dota players has been one of the highest honors of my life, thank you.